A thoughtful, objective approach to portfolio management

Our goal is to help clients Pursue Better™ and enjoy the best experience possible. Our investment management consulting services are holistic and comprehensive and follow a disciplined approach shaped by decades of research to determine the most efficient investment policy.

We believe that security prices reflect all publicly available information as intense competition among market participants drives prices toward fair value. Our comprehensive approach includes implementing an asset allocation strategy, managing your investments for the long-term, taking advantage of proper tax strategies.

At IDA, our investment approach rests on four key ideas:

- Markets Work

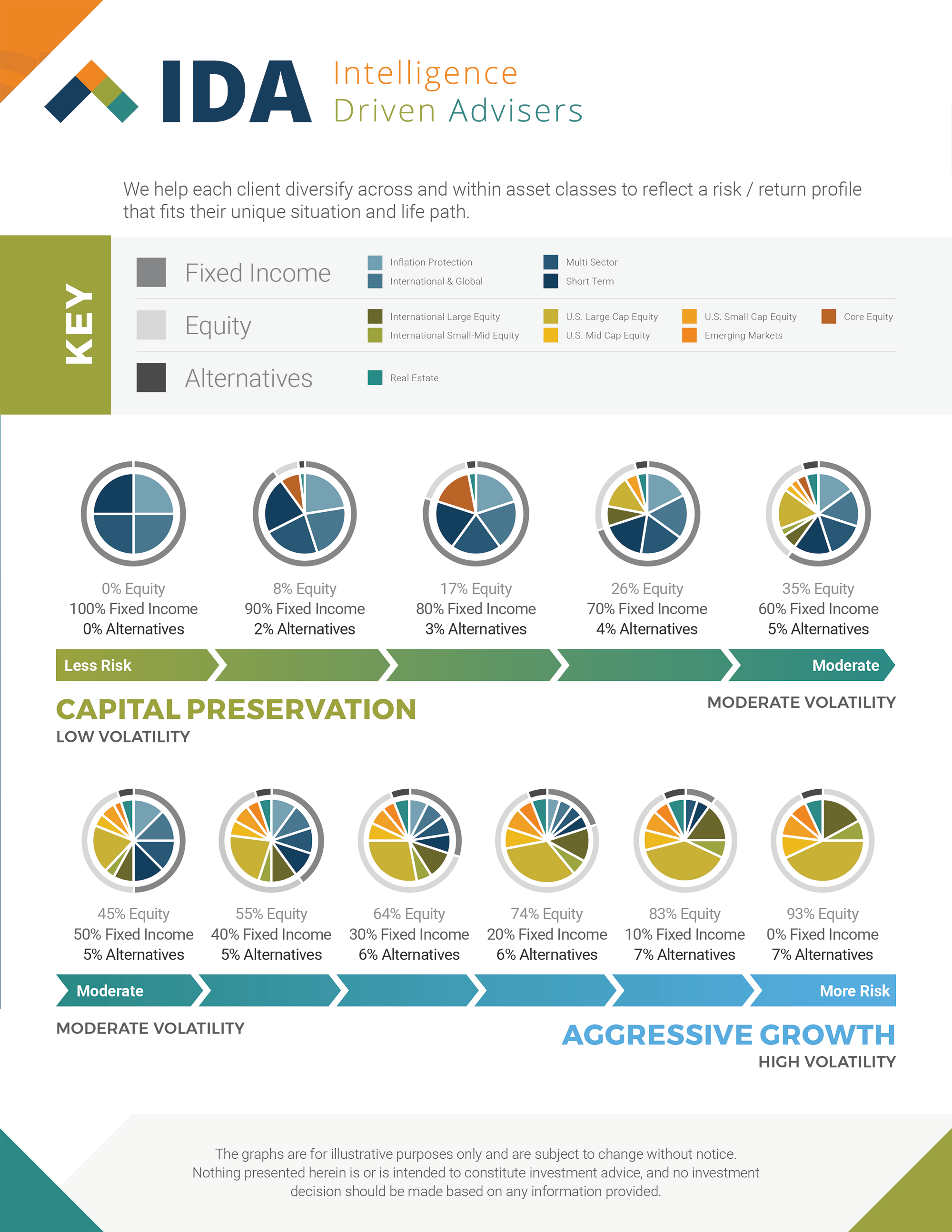

Capital markets do a good job of fairly pricing all available information and investor expectations about publicly traded securities. - Diversification is Key

Comprehensive, global asset allocation can neutralize the risks specific to individual securities. Including Alternatives in a portfolio has the potential to reduce volatility and increase returns. - Risk and Return are Related

The compensation for taking on increased levels of risk is the potential to earn greater returns. - Portfolio Structure Explains Performance

The asset classes that comprise a portfolio and the risk levels of those asset classes are responsible for most of the variability of portfolio returns.

With our clients specific and individual objectives in mind, we create a strategy designed to take the least amount of risk while achieving the stated goals and objectives.

Philosophy and Investment Considerations

- Disciplined Investing | Behavioral Coaching

- Select Core Allocation

- Optimize Allocation with Alternatives

- Tax-Loss Harvesting

- Tolerance Band Re-Balancing™

- Tax-Sensitive Asset Location

Our Wealth Management Process

Process Drives Outcomes. We Have a Clear One. And We Adhere to It.

- BE UNDERSTOOD.

What’s important to you and us - BE INFORMED.

Know what’s real, what’s right, what’s noise - BE STRATEGIC.

A detailed plan and discipline for your life and wealth - GET IT IMPLEMENTED.

Coordinate goals, tactics, professionals, and actions - TRACK SUCCESS. RECALIBRATE.

Know when you’re on track. Recalibrate if not - STAY FOCUSED.

Constant reflection on what’s important, why and how